What’s Bad for the (US) Gander is Good for the Gold

on 12/26/2012 09:25 in Investing / no comments

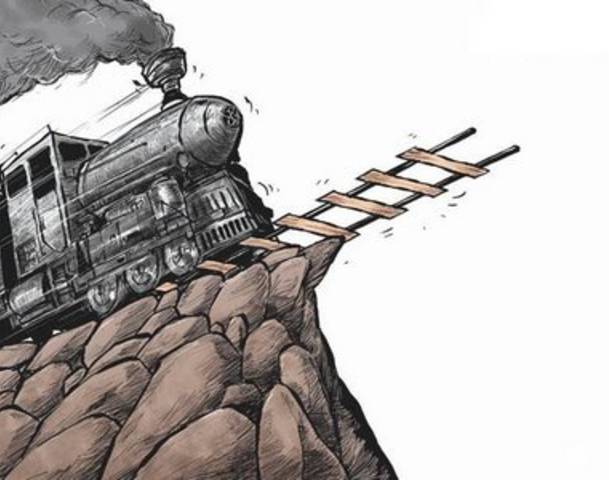

As the fiscal cliff draws closer to the speeding train of US investors, experts speculate on where should be the safest place to park their money. Gold has always been a good insurance policy, regardless of how well the story ends. However, in the case of 2013, the worst scenario could provide investors with the best reason to fill their baskets with gold bullion.

If the economy is allowed to go over the fiscal cliff, thus confirming that those is Washington are more interested in their own agendas than the good of the nation, gold should be expected to rise. During periods of extreme economic hardship, like another recession, commodities, particularly precious metals, tend to be a good store of wealth. Additionally, given the reliance of so many nations on the U.S., another severe recession at home will likely have reverberations that traverse the globe. Gold is a particularly good insulator against country-specific risk.

Read more at The Motley Fool

“The best thing for gold right now is a disaster,” explains strategist Nick Brooks of ETF Securities. What investors may be wondering, is what happens if Washington is able to avoid a fiscal catastrophe? A better question might be, is there really any possible outcome to current events that will be truly positive? Due to investors doing what they do best, which is ignoring uncertainty and deploying more capital; we can assume the US dollar will weaken, regardless , providing just enough tragedy to put gold investors in a safe place.

Regardless of your confidence in the heroes of Washington, standing on the sidelines with a gold bullion in your pocket, could be the best way to ring in the New Year.

Recent Posts

- Retirement Strategies

- Gold Takes a Backseat to Oil

- Silver Eagle Sales Gets a New Years Goose

- Australia May be an Upcoming REM Goldmine

- APMEX Joins eBay

0 Comments

You can be the first one to leave a comment.